[ad_1]

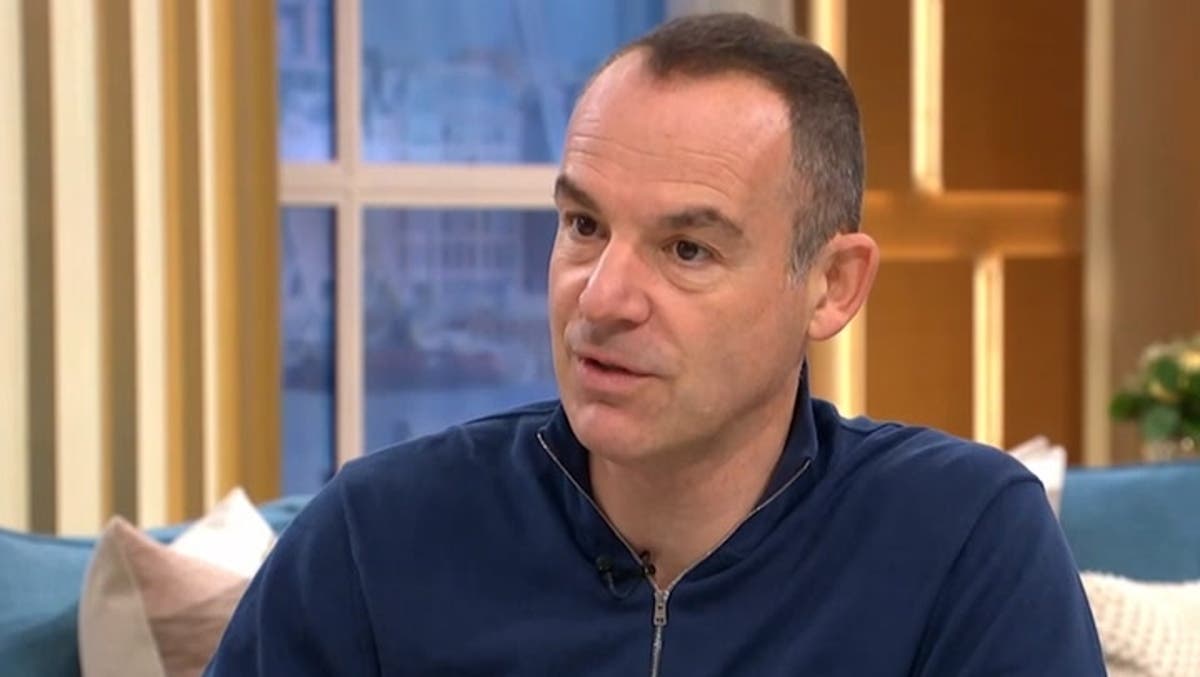

Martin Lewis has issued a warning to drivers a few ‘ridiculous’ car insurance rule the place customers could see their funds double.

The Money Saving Expert revealed insurance firms decide their renewal worth based mostly on ‘actuarial risk’ – which means the longer you allow it, the upper the premium could be.

He discovered some companies had been charging clients as much as 100% extra for leaving it till the final minute to resume.

Martin Lewis advised ITV’s Tonight programme: “It seems absolutely ridiculous but insurance pricing is all about actuarial risk.

“And what their risk shows them is the type of people who get car insurance early are a lower risk so they give them a lower price.

“You might pay nearly double if you wait until the last minute to get your car insurance.”

The common quote on the day of renewal was £1,198, in line with a Money Saving Expert evaluation of 70 million quotes throughout quite a few comparability websites.

The excellent time to resume is precisely 23 days earlier than your coverage expires, the Money Saving Expert mentioned.

By renewing simply over three weeks earlier than the top of a coverage’s finish, drivers can save greater than £500 and safe a contract for £694.

Martin Lewis defined: “That’s not for your renewal quote, that’s for going onto comparisons to get different quotes.”

Even if the three-week mark has handed it’s nonetheless potential to avoid wasting a considerable quantity of cash, he added.

[ad_2]

Source hyperlink