[ad_1]

Have you ever had your debit card or bank card data stolen from an ATM? If you might have, you’ll have fallen sufferer to a skimmer. Tiny units utilized by fraudsters referred to as “skimmers” might be connected to ATMs and used to steal information off of your debit or bank card magnetic strip.

There’s additionally an excellent smaller machine referred to as a “shimmer” that may be put in by fraudsters into an ATM that steals information from your credit score or debit card chip if in case you have a more moderen chip-based card. If you are anxious about falling sufferer to skimmers and shimmers, your first line of protection is to perceive what these items are and the way to hold your self protected.

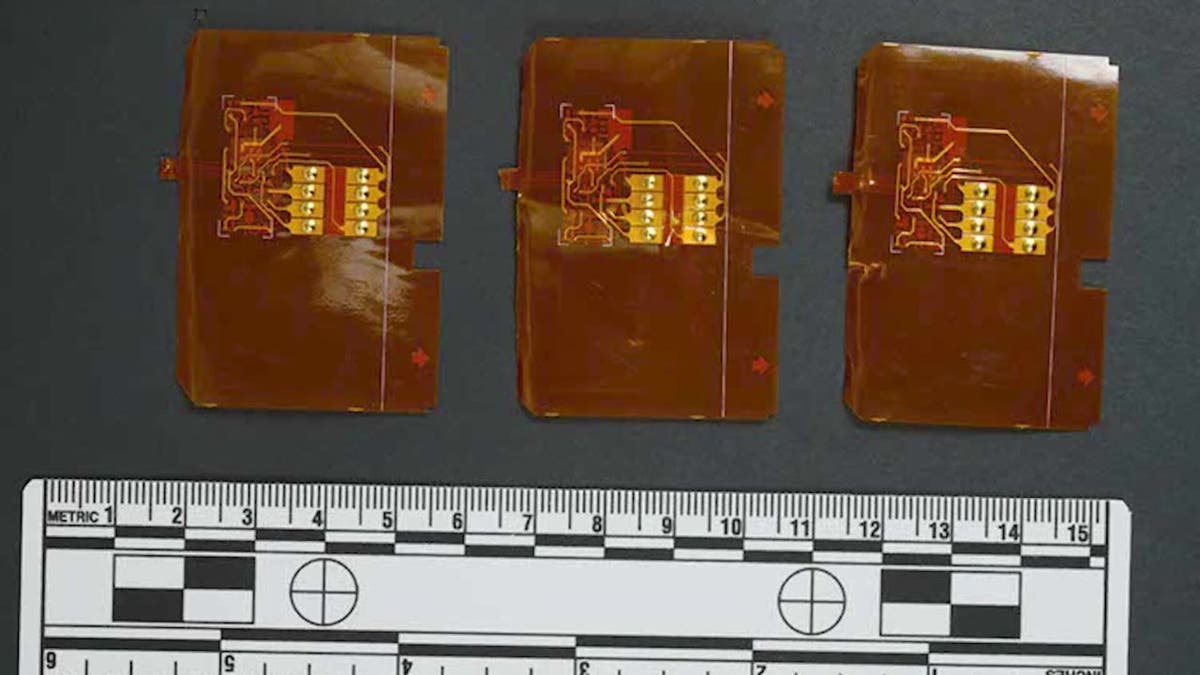

Two examples of skimmers (Dubuque Police Department) (Kurt “CyberGuy” Knutsson)

How does a ‘skimmer’ work?

Skimmers are faux card readers that may be put in on prime of official card readers and steal information from each one that makes use of the cardboard reader. These might be discovered on ATMs, gasoline pumps and almost some other card reader machine out within the public. Breaking into an ATM is not any simple feat, so thieves usually put skimmers on prime of the already-existing card reader.

Even extra disturbing, although, is that these thieves can even place a hidden digicam someplace close to the keypad of the cardboard reader in order that they’ll seize PINs. Some criminals even place false quantity pads to seize PIN codes, eliminating the necessity for a hidden digicam.

MORE: TIPS TO FOLLOW FROM ONE INCREDIBLY COSTLY CONVERSATION WITH CYBERCROOKS

Example of hidden digicam, skimmer and keypad overlay (FBI) (Kurt “CyberGuy” Knutsson)

How to spot a skimmer

Luckily, there are just a few tell-tale indicators to see if an ATM you might be utilizing has been corrupted by thieves with a skimmer. The first step to recognizing a skimmer is to pay shut consideration to the colour of the cardboard slot. Typically, on most ATMs, the cardboard slot and ATM would be the similar colour. If you discover that there is a cumbersome, differently-colored card reader, there is a fairly good probability it is a skimmer. Skimmers are additionally put in over the unique card reader, so that you would possibly discover some dried glue or adhesive across the card reader. Never use a card reader, whether or not at a gasoline pump or an ATM, in the event you suspect a skimmer machine has been put in over the unique card reader.

MORE: HOW TO FIGHT BACK AGAINST DEBIT CARD HACKERS WHO ARE AFTER YOUR MONEY

Beyond skimmers, watch out for the rise in shimming

Skimming is much less prevalent than it used to be, however you continue to ought to all the time examine the cardboard reader and keypad of an ATM earlier than utilizing it, in case a criminal has put in a skimmer on it. This is very pertinent in case you are touring overseas, the place skimmers are often utilized by thieves in main vacationer areas. However, as skimmers have declined, a brand new method to steal card information has change into widespread, referred to as “shimming.”

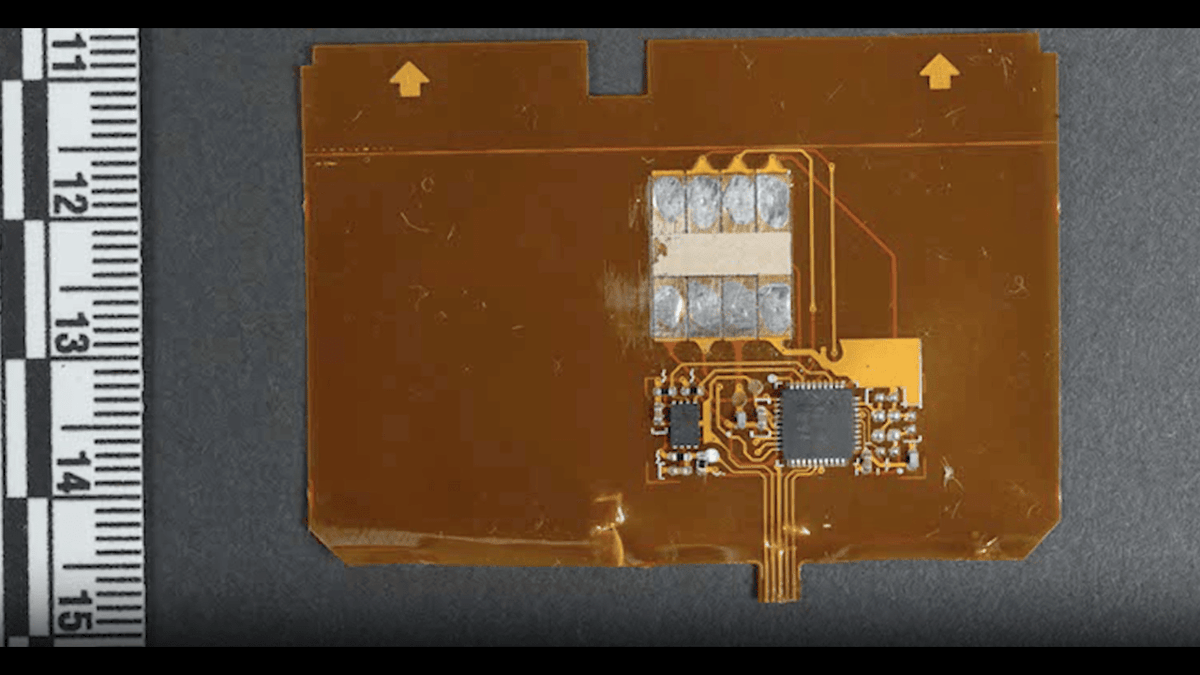

Example of shimmer (Royal Canadian Mounted Police) (Kurt “CyberGuy” Knutsson)

MORE: GOT A CREDIT CARD FRAUD ALERT? HOW CROOKS SWIPE YOUR PAYMENT CARD DETAILS

What are shimmers?

Skimmers usually do not work on chip-based credit score and debit playing cards, referred to as EMV playing cards, which supply a extra sturdy set of security measures, corresponding to double encryption between the chip and the magnetic stripe on the again of your card. As you would possibly count on, nevertheless, thieves adapt shortly and have developed a system referred to as “shimmers,” which can be utilized to steal the information from your chip-protected card.

Shimmers are paper-thin units with a microchip put in on them which might be inserted by thieves into ATMs. You cannot see a shimmer from the skin like you’ll be able to a skimmer, and when you insert your card into the affected ATM, the shimmer steals your card information off the chip, the identical method a skimmer would steal your information from the magnetic stripe.

Example of shimmer (Royal Canadian Mounted Police) (Kurt “CyberGuy” Knutsson)

How to hold your self protected from shimmers

Shimmers, as we simply mentioned, are not possible to see from the skin of an ATM or different pay terminal, however there are nonetheless just a few simple methods you’ll be able to hold your self from crooks utilizing shimmers.

Tip #1 – Avoid non-bank ATMs

ATMs which might be present in bars, comfort shops and different public locations fall sufferer to card skimmers and shimmers extra often due to their lack of security measures compared with financial institution ATMs. Bank ATMs are all the time the most secure to use.

Tip #2 – Utilize contactless funds

An simple method to hold your self protected when utilizing pay terminals is to use contactless fee programs, corresponding to Apple Pay, Google Pay, Venmo and PayPal, with your telephone as a substitute of inserting your card.

Apple Pay (Apple) (Kurt “CyberGuy” Knutsson)

MORE: BEST IDENTITY THEFT PROTECTION SERVICES 2024

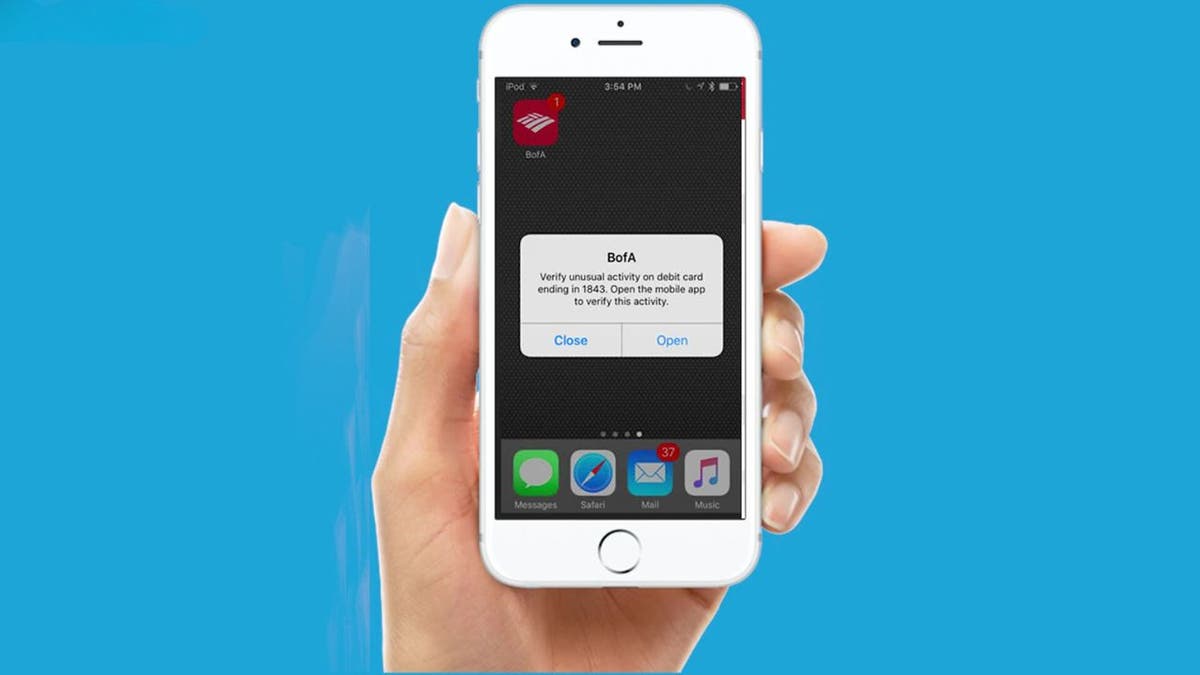

Tip #3 – Activate financial institution alerts on your playing cards

You can activate cellular alerts on your playing cards via your financial institution’s cellular app, which can provide you with a warning to any costs being made. This may help hold you protected by shortly figuring out any fraudulent costs that want to be canceled.

Bank alert (Bank of America) (Kurt “CyberGuy” Knutsson)

MORE: HOW TO EASILY ADD YOUR CREDIT CARDS AND LOYALTY PASSES TO YOUR IPHONE

Kurt’s key takeaways

Even in the event you do every little thing proper and go over each inch of an ATM, you, sadly, can nonetheless fall sufferer to a shimmer. Always bear in mind, in the event you suspect you have been a sufferer or credit score or debit card shimming and skimming, report any fraudulent transactions to your financial institution instantly. You will not be held liable, and your money will likely be returned to your account. Try to keep away from utilizing non-bank public ATMs as a lot as potential, and when potential, decide to use a contactless fee methodology as a substitute of inserting your card reader right into a terminal.

What extra safety measures do you assume could possibly be carried out to shield shoppers from skimmers and shimmers? Let us know by writing us at Cyberguy.com/Contact.

For extra of my tech suggestions & safety alerts, subscribe to my free CyberGuy Report Newsletter by heading to Cyberguy.com/Newsletter.

Ask Kurt a query or tell us what tales you need us to cowl.

Answers to essentially the most requested CyberGuy questions:

Copyright 2024 CyberGuy.com. All rights reserved.

[ad_2]

Source hyperlink