[ad_1]

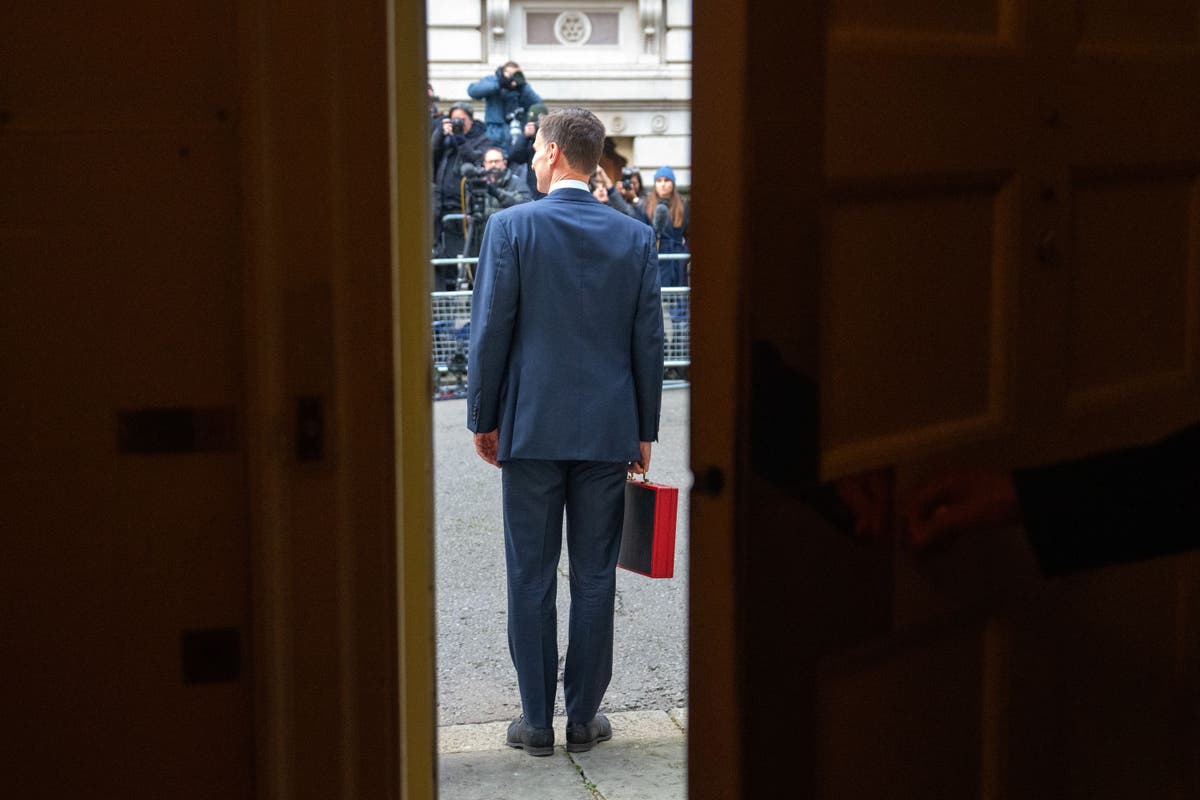

The massive information, however not the massive shock, from Jeremy Hunt’s spring Budget was that thousands and thousands of employees are set to profit from an extra 2p reduce in national insurance.

The chancellor introduced the measures in an try to ease the tax burden forward of subsequent yr’s normal election.

He additionally confirmed a brand new levy on vaping, an abolition of the non-dom tax standing and one other extension of the gas obligation freeze – that means motorists will proceed to save on petrol costs.

As we heard Mr Hunt ship the ultimate finances from Rishi Sunak’s present authorities, I’ve been answering questions from readers concerning the spring assertion – from the intricacies of national insurance cuts to Tory poll numbers.

Here are 9 questions from Independent readers – and my answers from the “Ask Me Anything” occasion.

Q: Can the Tories afford to win the General Election now they’ve set so many financial traps for Labour?

Slightly Tipsy Max

A: Good query. Neither social gathering can afford to win the election. Whoever is the subsequent authorities will face robust choices concerning the public funds. It would clearly be simpler for Labour to take care of these decisions, as a result of public opinion can be extra inclined to give a brand new authorities the advantage of the doubt – for a number of months at the very least.

Q: How does a reduce in NI create extra jobs as Hunt claims?

Jeceris

A:At probably the most primary stage of financial idea, should you scale back the worth of one thing it will increase demand. Cutting NI has the impact of decreasing the worth of labour and makes it barely cheaper for employers to rent folks. Hunt claimed the Office for Budget Responsibility modelling exhibits a job-creating impact, and I assume that is true.

Q: Who is double checking all the excellent news? He doesn’t point out the actual fact UK’s financial system has been destroyed and lots of companies have left and are nonetheless leaving, if not closing down. Listening to Hunt, the UK couldn’t have been doing higher ever. Reality could be very totally different although! The UK just isn’t supporting its companies or inhabitants in any approach.

Responsible

A: As with most chancellors in most Budget speeches, Jeremy Hunt was selective within the figures he quoted. This or that was the perfect within the G7, whereas a extra balanced presentation can be that the UK’s financial report and outlook will not be horrible however nothing particular.I don’t assume it’s truthful to say that the federal government just isn’t supporting the inhabitants in any approach, although. Many of Hunt’s fiscal issues have been made tougher by the furlough scheme and enterprise help in the course of the pandemic, and the power worth subsidy since.

Q: John, why can those that are of retirement age not pay national insurance? There is a variety of speak about generational unfairness however this would appear wise, could even fund common social care and an elevated state pension.

Mrpipesf

A: The break up between revenue tax and national insurance is certainly one of many illogical options of the British tax system. Jeremy Hunt appears to be pursuing one route to ending the unfairness, by regularly abolishing national insurance contributions. But we must always level out that these cuts (2p within the £ in Jan, one other 2p in Apr) are to worker contribution charges solely – employers proceed to pay a big, and largely invisible tax in employer contributions.

In an excellent world, revenue tax and national insurance must be merged, which might imply older folks on greater incomes would pay extra. But no politician is prepared to lose these votes.

Q: Is it right {that a} 2% reduce in NI means somebody on £25,000 will get a tax reduce of £248, whereas somebody on £50,000 will get thrice as a lot, £748?

Neil Lamputt

A: I believe it’s greater than that. Today’s reduce is price £435 a yr to somebody on £25k a yr, and £1,310 to somebody on £50k. That is my objection to it, and the earlier reduce: they’re price extra in money phrases to folks on greater incomes. Norman Lamont’s election-profitable Budget in 1992 shot Labour’s fox by chopping revenue tax for folks on decrease incomes, which might have been a greater concept.

Q: Could something he mentioned make any distinction to Tory poll numbers?

Mark Burns

A: I don’t assume something Hunt mentioned will make a distinction to Tory poll numbers, primarily as a result of it was all already within the public area, however that doesn’t imply that he *couldn’t* have mentioned something that may transfer the numbers.

Q: How can the speaker get the federal government to announce stuff in parliament earlier than briefing the papers? (And does it matter)

Ali Hughes

A: In the outdated days there have been weeks of “purdah” earlier than a Budget, when the Treasury would go darkish and journalists actually have been simply speculating, largely wrongly, about what could be introduced.

In Gordon Brown’s time particularly, the Treasury turned a way more communications-acutely aware division, and would leak or formally announce measures upfront to strive to create a wave of stories tales to put together the best way for the one remaining theatrical shock on the day. Now it’s all pre-introduced and there’s no shock on the day.

I think about Hunt wished the 2p national insurance reduce to be a shock, however information seeped out as a result of MPs have been warned upfront that additional laws can be wanted (which it might be for NICs however not for revenue tax modifications), and it’s nearly unimaginable to maintain a authorities secret nowadays.

The speaker can strive to order the tide to retreat, however he may have no luck.

Q: What are the dangers with additional tax cuts within the present UK fiscal and financial setting?

outdated dane

A: An excellent query! At a number of moments in Hunt’s speech I believed it was “Trussonomics by stealth”. He and Rishi Sunak are treading a wonderful line between, on the one hand, reassuring the markets that they’ve a grip on the general public funds, and on the opposite, having to do irresponsible issues in a determined try to win the election.

The markets need to be fooled, and so settle for unrealistic future public spending plans so long as the Office for Budget Responsibility continues to grumble quite than insurgent.

But as I say, actually taxes must be going up, not down.

Q: If the Tories consider that there isn’t any hope on the subsequent election are they imply sufficient to salt the earth within the subsequent finances for the subsequent authorities making it even more durable to start to clear up earlier than the election after that? If so what might the Chancellor do?

fistfulloffishes

A: I’m undecided that Sunak and Hunt are intentionally “salting the earth”. That implies that they’ve given up and easily need to make life troublesome for his or her opponents. But politicians all the time delude themselves that they’ll win – keep in mind that Sunak, for instance, thought his profession was over when Liz Truss gained the management election, solely to discover himself in No 10 at quick discover.

These questions and answers have been a part of an ‘Ask Me Anything’ hosted by John Rentoul at 3pm GMT on Wednesday 6 March. Some of the questions and answers have been edited for this text. You can learn the total dialogue within the feedback part of the authentic article.

John additionally sends a weekly Commons Confidential publication unique to Independent Premium subscribers, taking you backstage of Westminster. If this seems like one thing you’d be focused on, head right here to discover out extra.

[ad_2]

Source hyperlink