[ad_1]

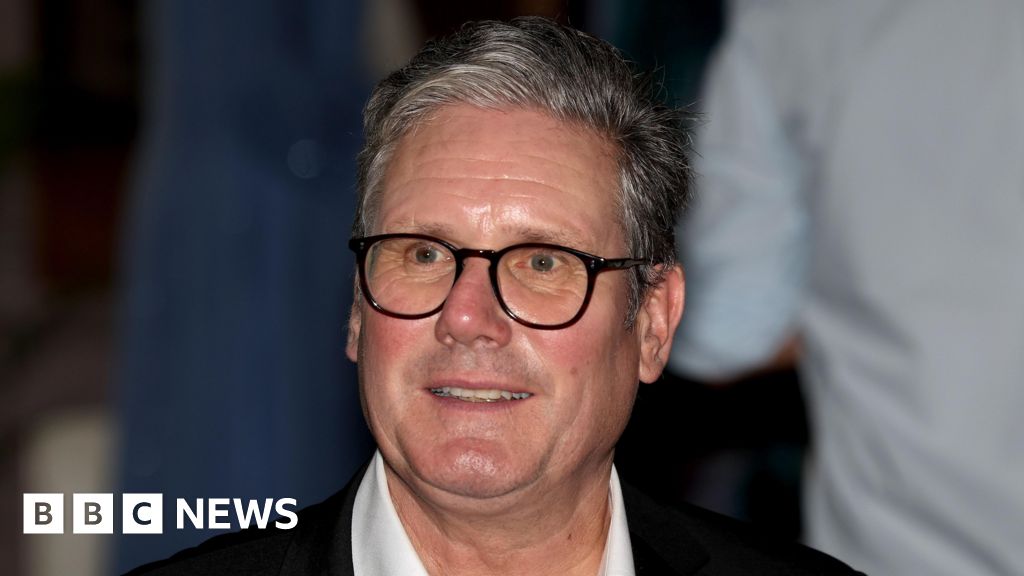

Getty Images

Getty ImagesSir Keir Starmer has tried to define who “working people” are, amid renewed scrutiny of his tax plans forward of subsequent week’s Budget.

Labour promised on the basic election not to improve taxes on working folks – however it’s trying to increase some taxes to fund public providers.

This may embrace will increase in tax on the sale of property, equivalent to shares and property, a freeze on revenue tax thresholds and adjustments to inheritance tax.

Sir Keir has repeatedly been requested whether or not “working people” can be hit by these adjustments.

He insists they will not however has struggled to provide a transparent definition of what counts as a working particular person within the authorities’s eyes.

In an interview throughout a Commonwealth leaders’ summit, the prime minister was requested whether or not those that work, however get extra revenue from property equivalent to shares or property, would rely as working folks.

He replied that they “wouldn’t come within my definition” – however warned in opposition to making “assumptions” about what that meant for tax coverage.

He mentioned he considered a working particular person as somebody who “goes out and earns their living, usually paid in a sort of monthly cheque” and who can’t “write a cheque to get out of difficulties”.

Speaking afterwards, his spokesman sought to clarify that those with a “small amount of savings” could still be defined as working people.

This could include cash savings, or stocks and shares in a tax-free Individual Savings Accounts (ISA), he suggested.

But ministers have been reluctant to translate these comments into numbers.

‘Hypotheticals’

The prime minister accepted that his own definition was “broad”.

Those people he had in mind, he added, were those who were “doing alright” however had an “anxiety in the bottom of their stomach” about making ends meet if something unexpected happened to their family.

The issue has taken on a central political importance ahead of next Wednesday’s Budget, Labour’s first since 2010, amid a row over whether the party is sticking to promises it made in its election manifesto.

During a BBC interview back in the UK, Treasury minister James Murray was asked repeatedly to give a more precise answer.

When asked whether someone who owned shares or sold a business could be a working person, he said he would not “get into too many hypotheticals”.

As well as the broad pledge not to raise taxes for working people, Labour’s manifesto specifically ruled out raising rates of income tax, along with National Insurance and Value Added Tax (VAT).

But ministers have not ruled out continuing to freeze income tax thresholds beyond 2028, a policy they inherited from the Conservatives, dragging more people into higher bands over time as wages rise with inflation.

And they have also not ruled out making employers pay National Insurance on their contributions to workers’ pension pots, which the Conservatives have branded a “tax on work” that will indirectly hit workers.

Labour peer Lord Blunkett, a cabinet minister in the Blair government, said the “logical outcome” of the transfer was that “employers pays much less”.

He also cautioned that he was unsure of the government’s definition of a working person, adding: “We’ve received to discover a completely different phrasing”.

Other rumoured tax rises include to capital gains tax, which is paid on profits made by selling assets including shares and property other than a main home.

The government is also planning to increase the amount of money it raises in inheritance tax, which is paid after around 4% of deaths.

Multiple adjustments to the tax, which presently contains a number of exemptions and reliefs, are into consideration.

[ad_2]

Source hyperlink