[ad_1]

It’s that point of yr once more, of us. Whether you have but to file your taxes or you’re in the course of it, it isn’t too late to verify you’re protected this tax season. With new tax fraud scams on the rise — many growing as a result of acceleration of AI — we would like you to take further safety measures to maintain your self secure from these scams. But how? Here’s why you need an Identity Protection Pin this tax season.

Post-it be aware on tax paperwork (Kurt “CyberGuy” Knutsson)

Scammers who commit tax fraud are on the rise

Last yr, over one million tax returns have been flagged for doable id theft, and the numbers aren’t trying to go down any time quickly. With the developments in AI, savvy scammers can extra effectively steal somebody’s id, create a pretend ID and file a tax return within the sufferer’s title.

When they do this, they will get a tax refund despatched on to their checking account, all of the whereas inflicting havoc for the sufferer, who will study of the rip-off typically when it is too late once they go to file their taxes.

The phrase rip-off is written on tax paperwork. (Kurt “CyberGuy” Knutsson)

MORE: DON’T FALL FOR THESE SNEAKY TAX SCAMS THAT ARE OUT TO STEAL YOUR IDENTITY AND MONEY

What is an Identity Protection Pin and the way does it preserve you secure?

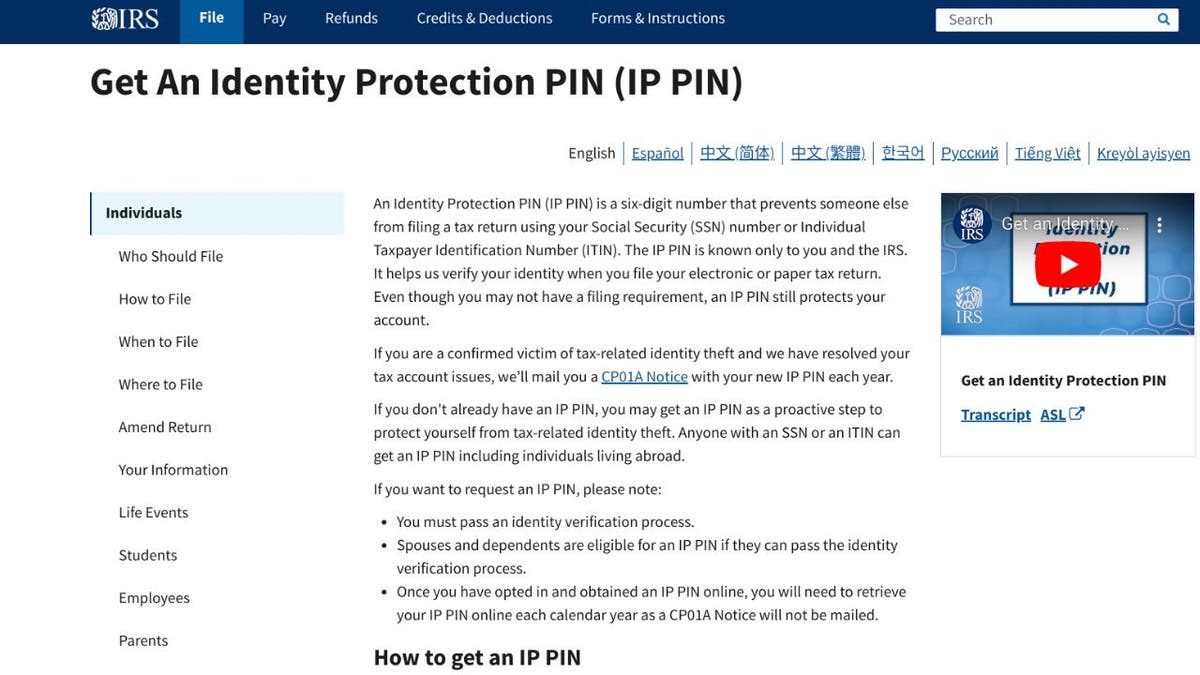

To fight tax id theft, the IRS has created Identity Protection (IP) PINs. These are six-digit, personalised numbers that you are requested to enter when submitting your tax return, both electronically or on paper. While it isn’t a requirement for everybody to have an IP PIN, the IRS will assign one to those that have been beforehand victims of tax fraud and require them to make use of it.

But, for individuals who haven’t been victims of tax fraud earlier than, as decided by the IRS, it is nonetheless a good suggestion to get your self an Identity Protection PIN anyway. This PIN — so long as you do not share it with anybody — helps forestall scammers from submitting tax returns in your title along with your compromised id. Without that pin, they will not have the ability to go a step additional.

So, why wait till you turn out to be a sufferer of tax fraud? If that occurs, you’ll need an IP PIN anyway. Stop these scammers of their tracks as a result of these scammers are extra refined. Sure, it might take a little bit longer to file your return, however it’s value it.

IP PIN web page on IRS web site (Kurt “CyberGuy” Knutsson)

MORE: HOW CRYPTO IMPOSTORS ARE USING CALENDLY TO INFECT MACS WITH MALWARE

How to use for an Identity Protection Pin

To apply for an IP PIN, go to the IRS’ on-line instrument. Have your legitimate Social Security quantity or particular person taxpayer identification quantity (ITIN prepared). Remember, if the IRS has already decided that you’re a sufferer of tax fraud, they will have already got assigned you an IP PIN.

If you apply on-line, you can get your IP PIN in about quarter-hour, offered you meet the eligibility necessities. Applying by mail utilizing Form 15227 takes longer. The IRS will sometimes mail you your IP PIN inside 4 to 6 weeks after verifying your id. Luckily, the April 15 deadline applies to submitting your tax return, not essentially acquiring an IP PIN. So, so long as you obtain your IP PIN earlier than you file, you ought to be nice.

Once your software is authorized, the IRS will assign you a six-digit IP PIN. Write this down someplace secure. Once you obtain your IP PIN, you will not have the ability to file your tax return with out it.

How do I exploit my IRS IP PIN?

If you file your tax return your self as a result of you’re eligible through Direct File on the IRS web site, then you’ll be prompted to place in your IP PIN when you log in to your account. But, if you have an accountant, wait till you evaluate the tax return they’ve put collectively earlier than you share your pin with them to do it through the IRS web site. Otherwise, if you’re submitting the tax return through tax software program, it ought to immediate you to place in your IP PIN earlier than going ahead. If you need assist along with your IP PIN, go to the IRS’s FAQs or contact the IRS straight.

Important Information about IP PINs

Here’s further data you would possibly need to find out about IP PINs.

- An IP PIN is legitimate for one calendar yr. If you have already got a pin, when you log within the subsequent yr, you’ll be granted a brand new pin.

- A return filed with out the code will not be accepted. While this could also be an annoyance for some taxpayers, it is all to assist curb a lot of scams taking place, which is leading to greater than $6 billion in tax refunds despatched out to the mistaken individuals.

- Logging again into the “Get an IP PIN” instrument will show your present IP PIN.

An individual making ready their taxes (Kurt “CyberGuy” Knutsson)

MORE: CONFESSIONS FROM A VICTIM SCAMMED BY CYBERCREEPS

How can you shield your self from tax-related id theft?

Use an id theft safety service

If you’re anxious about scammers not simply desirous to commit tax fraud, however stealing your data for any of their malicious causes, like id fraud, we perceive. There are so many scams on the market and a lot data that you need to know to maintain your self protected. Luckily, there are answers that may assist, together with an id theft safety service.

Identity Theft firms can monitor private data like your Social Security Number, cellphone quantity and electronic mail tackle and alert you whether it is being offered on the darkish internet or getting used to open an account. They may help you in freezing your financial institution and bank card accounts to forestall additional unauthorized use by criminals. See my suggestions and greatest picks on learn how to shield your self from id theft.

Have good antivirus software program

The greatest approach to shield your self from clicking malicious hyperlinks that set up malware that will get entry to your personal data is to have antivirus safety put in on all of your units. This may alert you of any phishing emails or ransomware scams. Get my picks for the most effective 2024 antivirus safety winners on your Windows, Mac, Android & iOS units.

5 issues to do if you are a sufferer of id theft

1) Complete IRS Form 14039, the Identity Theft Affidavit. This is the shape that every one victims of fraud should fill out for the IRS. It will allow them to know that the individual claiming to be you is a fraud. You can discover the shape on the IRS web site.

2) Request a replica of the fraudulent tax return from the IRS. You can do this by going to this web page on the IRS web site to learn to take care of fraudulent returns and observe the directions to order a replica.

3) Alert nationwide credit score bureaus: Let the nationwide bureaus like Experian, Equifax and TransUnion know that there was fraud and place a freeze in your account in order that the scammers can not get to it.

4) Report the crime to the Federal Trade Commission: The FTC is there to assist observe down scammers, and your report may assist them preserve a document of what number of scams are taking place in a single yr in order that they will higher enhance learn how to warn others. You also needs to report the crime to identitytheft.gov/.

5) Check your on-line financial institution accounts: Make certain there are not any suspicious transactions on any of them.

Kurt’s key takeaways

Tax fraud will not be new, however it’s taking place way more steadily lately. The IRS is doing its half to attempt to shield taxpayers, however it’s not straightforward to maintain up. By making use of for the Identity Protection PIN, you may also help them assist you.

In your opinion, how can the IRS higher educate taxpayers about defending themselves from tax scams? Let us know by writing us at Cyberguy.com/Contact.

For extra of my tech suggestions & safety alerts, subscribe to my free CyberGuy Report Newsletter by heading to Cyberguy.com/Newsletter.

Ask Kurt a query or tell us what tales you’d like us to cowl.

Answers to essentially the most requested CyberGuy questions:

Copyright 2024 CyberGuy.com. All rights reserved.

[ad_2]

Source hyperlink