[ad_1]

When you consider “tax fraud,” you most likely assume of people that discover methods not to file their taxes actually. But with the development of synthetic intelligence, there is a new kind of tax fraud on the market.

This one includes hackers utilizing a type of id hijacking to file a tax return in another person’s name and get the refund despatched to them.

The darkish internet is revealing that tax fraud is on the rise. Here’s what you want to look out for to keep away from turning into a sufferer.

Post-it be aware on a tax type (Kurt “CyberGuy” Knutsson)

What is AI-powered fraud and id hijacking?

AI-powered fraud is when hackers make the most of AI’s talents to commit subtle acts of fraud. One kind of AI-powered fraud is named id hijacking, which is when hackers not solely steal somebody’s id however impersonate them in all types of the way. One instance is thru deepfakes, which may have scary penalties for extra than simply the individual being impersonated.

WHAT IS ARTIFICIAL INTELLIGENCE (AI)?

Another is thru AI tax fraud, which is when the hacker makes use of AI to take your delicate data and use it to finally get your tax return despatched to them.

But how precisely do they do that?

Laser scanner over an individual’s face (Kurt “CyberGuy” Knutsson)

MORE: DON’T FALL FOR THESE SNEAKY TAX SCAMS THAT ARE OUT TO STEAL YOUR IDENTITY AND MONEY

How fraudsters are utilizing AI to commit tax fraud

This new kind of tax fraud was reported by the CEO of LexisNexis Risk Solutions’ Government group, Haywood Talcove, a cybersecurity and information evaluation firm.

The acceleration of fraud via AI

Historically, tax fraud has concerned the use of stolen Personally Identifiable Information (PII), which refers to information that can be utilized to determine you. It consists of each delicate and non-sensitive data.

Sensitive PII: Full name, Social Security quantity, driver’s license, mailing deal with, bank card particulars, passport data, monetary information and medical historical past. Companies typically use anonymization strategies to defend delicate PII when sharing information.

Non-sensitive PII: Zip code, race, gender, date of delivery and even data accessible on social media websites. While non-sensitive PII is much less crucial, it will probably nonetheless contribute to figuring out you.

Thanks to AI, criminals can now extra effectively exploit stolen (PII) Personally Identifiable Information for fraudulent actions.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The course of: From PII theft to faux IDs

Hackers might purchase PII via varied means, equivalent to phishing scams or malware. This data is then used to create fraudulent IDs, full with the sufferer’s particulars however the fraudster’s {photograph}.

Exploiting facial recognition for IRS entry

With a faux ID in hand, fraudsters can bypass the IRS’s facial recognition safety measures, permitting them to file tax returns in the sufferer’s name and redirect refunds to their accounts.

IRS paperwork (Luke Sharrett/Bloomberg through Getty Images)

The name for enhanced verification measures

Experts are urging authorities companies to implement extra strong verification processes, equivalent to cross-referencing IDs with DMV information, to fight this subtle type of tax fraud.

MORE: WHY YOU SHOULD NEVER CARRY THESE THINGS IN YOUR WALLET

How to decide if somebody filed a tax return in your name

When the IRS identifies points with your tax return, it’ll ship you a letter earlier than issuing any refunds. This notification gives a possibility for you to flag the preliminary return as fraudulent and proceed with submitting usually.

The IRS employs programs to detect suspicious returns. However, if its algorithms fail to determine anomalies and course of a fraudulent return, you received’t uncover it till you try to file your personal return and encounter rejection.

In most circumstances, the second possibility is extra widespread. Taxpayers sometimes obtain an e-file rejection discover, which signifies an issue. Unfortunately, these notifications lack particular particulars. Instead, they merely spotlight a problem associated to the Social Security quantity. If you haven’t by accident transposed any digits, it’s probably that tax id theft triggered the rejection.

What occurs after the scammer information a faux tax return in your name?

The main consequence of a faux tax return is the theft of your tax refund. The scammer primarily impersonates you and diverts your rightful return into his checking account. But the difficulty does not cease there. When you strive to file your respectable return, the IRS system will probably reject it due to a reproduction submitting. This throws you right into a bureaucratic maze to resolve the difficulty and show your id.

Adding to the frustration, tax id theft is a rising crime, and the IRS processes for resolving these conditions are nonetheless evolving. This can imply prolonged delays and uncertainty when you straighten issues out.

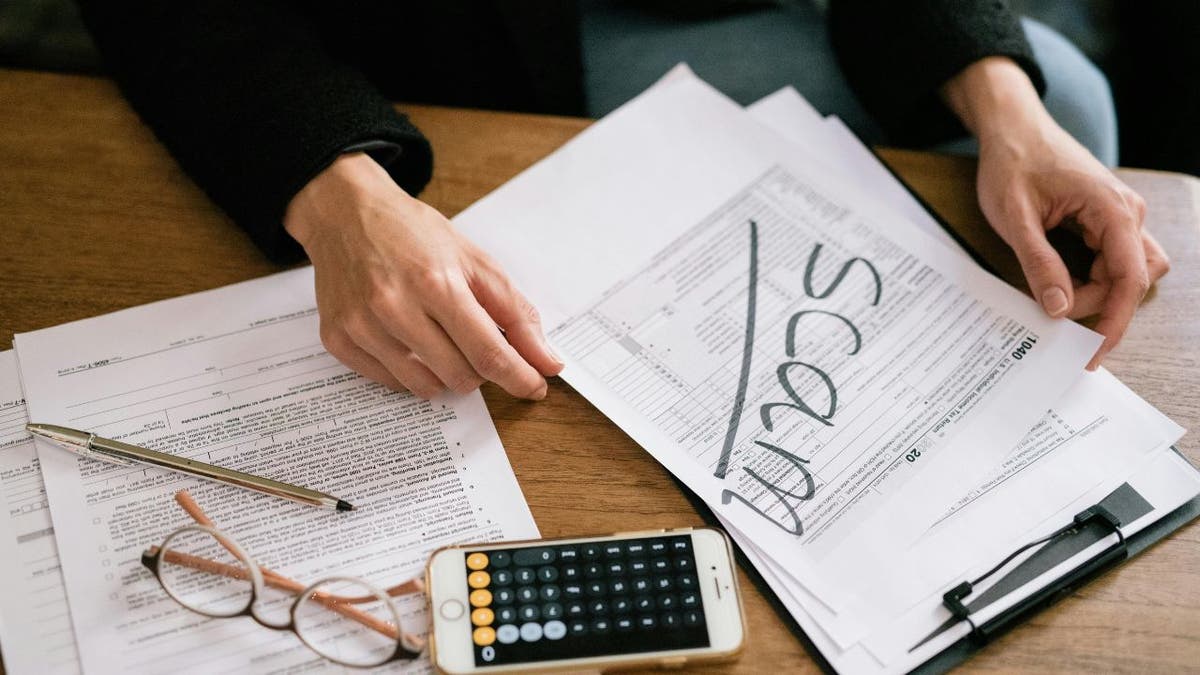

Scam written on tax paperwork (Kurt “CyberGuy” Knutsson)

MORE: HOW IMPOSTERS ARE TRYING TO EXPLOIT YOUR GRIEF AND WALLET IN A NEW FUNERAL SCAM

6 methods to defend your self from AI tax fraud

Again, since it is a comparatively new rip-off, cybersecurity consultants are nonetheless studying quite a bit about what it seems like and, subsequently, how to mitigate it. However, now that you’re conscious it’s on the market, listed here are six issues you are able to do to hold your self protected.

1. File your taxes as early as doable. If you beat them to it, they cannot commit the fraud.

2. Never share your private data, particularly your Social Security quantity or different PII data, on messaging apps or throughout a cellphone name with somebody you do not know. Many phishing makes an attempt lead individuals to give this data away earlier than they’ve even realized what has occurred.

3. Use robust passwords and reset them typically. Create robust passwords for your accounts and units, and keep away from utilizing the identical password for a number of on-line accounts. Consider utilizing a password supervisor to securely retailer and generate advanced passwords. It will aid you to create distinctive and difficult-to-crack passwords {that a} hacker may by no means guess.

4. Use an id theft safety service: Using an id theft safety service generally is a essential step in safeguarding your self towards tax fraud. Identity theft firms can monitor private data like your Social Security quantity, cellphone quantity and e-mail deal with and provide you with a warning whether it is being bought on the darkish internet or getting used to open an account. They can even help you in freezing your financial institution and bank card accounts to forestall additional unauthorized use by criminals. See my ideas and greatest picks on how to defend your self from id theft.

5. Don’t click on on hyperlinks or information when you do not know what they’re, even when they’re from a trusted pal. That pal may have been hacked, and now somebody is after you. The greatest method to defend your self from clicking malicious hyperlinks that set up malware which will get entry to your personal data is to have antivirus safety put in on all your units. This can even provide you with a warning of any phishing emails or ransomware scams. Get my picks for the most effective 2024 antivirus safety winners for your Windows, Mac, Android & iOS units.

6. Do your greatest to be sure that your delicate information isn’t straightforward to discover on-line. While no service guarantees to take away all your information from the web, having a elimination service is nice if you’d like to always monitor and automate the method of eradicating your data from a whole bunch of websites repeatedly over an extended time frame. Check out my prime picks for elimination providers right here.

If you think you’ve been a sufferer of tax fraud, the official IRS web site gives step-by-step steering on how to deal with the scenario.

Kurt’s key takeaways

It’s little question scary to take into consideration all of the alternative ways hackers and scammers can make the most of you. And as a result of AI is making their work simpler, it is onerous to sustain. What will they consider subsequent? That’s why, right here at CyberGuy, we do our greatest to hold you up to date on the newest hacking information, so you’ll be able to keep one step forward of the crooks.

CLICK HERE TO GET THE FOX NEWS APP

In gentle of the rising risk of AI-powered fraud, what extra safety measures do you assume the federal government ought to implement to safeguard your private data? Let us know by writing us at Cyberguy.com/Contact

For extra of my tech ideas and safety alerts, subscribe to my free CyberGuy Report Newsletter by heading to Cyberguy.com/Newsletter

Ask Kurt a query or tell us what tales you need us to cowl

Answers to essentially the most requested CyberGuy questions:

Copyright 2024 CyberGuy.com. All rights reserved.

[ad_2]

Source hyperlink