[ad_1]

Jeremy Hunt is claimed to be contemplating scrapping the non-dom tax loophole in a bid to fund nationwide insurance coverage or revenue tax cuts.

The chancellor is trying on the transfer forward of subsequent week’s Budget, in what could be a serious blow to Labour’s post-election spending plans.

Sir Keir Starmer’s occasion has promised to pay for NHS reform and faculty breakfast golf equipment with the cash it will increase by scrapping the tax break, which lets overseas nationals dwelling in Britain keep away from paying tax on abroad earnings.

It believes the transfer would increase round £2bn, but when Mr Hunt scraps or drastically alters the non-dom regime, Labour must discover the cash to fund the pledges elsewhere.

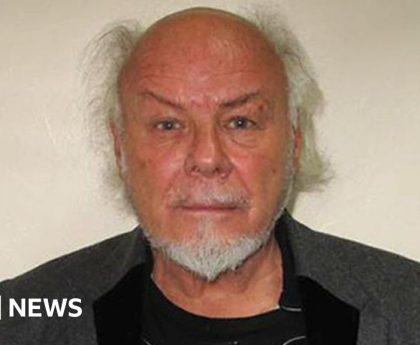

Jeremy Hunt is contemplating scrapping the non-dom loophole

(PA Wire)

Mr Hunt has reportedly been handed a “secret project list” of revenue-raising measures that will assist him fund additional pre-election giveaways to win over voters.

He is ready to take the transfer, first reported by the Financial Times, if pre-budget forecasts deteriorate within the run-up to subsequent Wednesday’s assertion.

The non-dom loophole was thrust into the highlight when The Independent revealed that Akshata Murty, Rishi Sunak’s spouse, had used it to save lots of probably thousands and thousands of kilos.

Ms Murty, whose household enterprise is estimated to be price round £3.5bn, later mentioned she would not declare the standing on her worldwide earnings. At the time she mentioned she didn’t need her tax standing to be a “distraction for my husband or to affect my family”.

But Labour has ruthlessly attacked the PM over The Independent’s revelation, with Sir Keir accusing Mr Sunak of desperately holding onto his “beloved non-dom status”.

Mr Sunak has been dismissive of Labour’s plans to scrap the loophole, describing Sir Keir’s assaults on the standing as “this non-dom thing”.

And Mr Hunt has mentioned abolishing the tax break doesn’t “make sense” and could be the “wrong thing” to do.

Asked in regards to the concept, he advised BBC Radio Four: “These are foreigners who could live easily in Ireland, France, Portugal, Spain. They all have these schemes. All things being equal, I would rather they stayed here and spent their money here.”

Labour mocked the potential u-turn on the tax standing, with a supply saying: “We will wait and see whether the chancellor manages to get this past Rishi Sunak given his family finances.”

Labour has mentioned it won’t reverse Mr Hunt’s tax cuts if it involves energy after the election, anticipated this autumn, which means the occasion could have to seek out different methods to fund its present spending pledges.

It has dedicated to spending £1.1bn on NHS operations, scans and appointments, £171m for well being scanners, £111m for dental appointments and £365m for major faculty breakfast golf equipment.

The the rest could be spent on extra funding for the Scottish, Welsh and Northern Irish governments.

Rachel Reeves has warned Labour will inherit the worst financial outlook for the reason that Second World War

(PA Wire)

The plans emerged as shadow chancellor Rachel Reeves warned Labour is ready to inherit the worst financial state of affairs of any incoming authorities “since the Second World War” if the occasion comes into energy on the subsequent common election.

Speaking with Sky News, Rachel Reeves pointed to “debt interest payments, growth, living standards and taxation” as she accused the Conservative Party of “burning the whole house down” throughout its time in authorities.

She advised the broadcaster: “This is the worst inheritance any incoming government will have had since the Second World War in terms of debt interest payments, growth, living standards and taxation.

“(Former chancellor) George Osborne said in 2010 that they were going to fix the roof. What they’ve done is smash the windows, broken the door down and are burning the whole house down.

“That is the reality for whoever is prime minister and chancellor after the next election – that’s the inheritance that whoever forms the next government is going to have to deal with.”

Ms Reeves signalled she would probably replicate any impending tax cuts, however they’d must be in step with her fiscal guidelines.

She mentioned: “Fiscal responsibility is non-negotiable for me. The sums have to add up.

“Everything will be subject to the fiscal rules I’ve set out.

“I want taxes on working people to be lower. But it has to be affordable.”

Next week’s Budget is without doubt one of the final main set items for the federal government earlier than voters head to the polls.

With the Conservatives dealing with a heavy defeat, Mr Hunt is below stress to seek out the money for a minimize to revenue tax or nationwide insurance coverage.

He is claimed to desire a nationwide insurance coverage minimize, following a discount within the tax introduced in November’s funds, in addition to a vape tax.

It is believed he could introduce a “vaping products levy” to be paid on imports and by producers to attempt to make the behavior unaffordable for kids.

[ad_2]

Source hyperlink