[ad_1]

Once upon a time, there was a young lady with £40,000 in the bank. This princely sum was garnered over a decade of scrimping and saving, with a little little bit of assist from the authorities’s lifetime ISA scheme – the place they gifted you £1k when you managed to deposit £4k in a 12 months – and topped up by, oh-so-inevitably, the Bank of Mum and Dad (in this case simply mum). She felt protected and safe, realizing that if one thing occurred – a sudden job loss or surprising well being situation – she would have a monetary buffer to assist climate the storm.

Then, she did what you’re alleged to do once you lastly purchase that stage of money: she purchased a home. And, inside the 12 months, almost each final penny of these once-lofty financial savings had been obliterated. She – or ought to I say “I” – had formally joined the 11 million-strong contingent of working-age Brits who presently have less than £1,000 of financial savings in the bank.

This is in keeping with a new report from the Resolution Foundation and the abrdn Financial Fairness Trust, which discovered that these with entry to less than a grand accounted for about one in three working-age households. It calculates that the UK has a £74bn shortfall relating to cash put aside for emergencies and retirement, in comparison with if every family had a minimal of three months’ wage saved.

When I noticed this, I nearly laughed out loud. Three months’ wage? I’d be fortunate to retailer up three days’ price.

I purchased my property in the autumn of 2022. At first, it wasn’t so unhealthy financially, regardless of residing alone for the first time and having to pay all the payments as a single-income family. However, final 12 months, as costs rose, the cost-of-living disaster began to chew and surprising outgoings like a new roof took their toll. I discovered myself having to repeatedly dip into the meagre financial savings I nonetheless had. Every month, I deposited £200 into my wet day fund. Every month, I moved it again to my present account, alongside with a bit further, throughout the week earlier than payday. As it presently stands, I’ve – deep breath – precisely £305.69.

To put this in context, I work full-time in a job with a wage that places me in the prime 25 per cent of earners in the UK. I don’t think about myself to have a notably extravagant life-style; I don’t personal a automotive, not often purchase garments different than the occasional £5 Vinted prime, and am in the insanely lucky place of not having needed to pay for a vacation in almost a decade, because of my earlier gig as a journey editor.

I do, admittedly, have a penchant for restaurant dinners and spicy margaritas. If I actually wished to, I may hand over these valuable nights out with mates. But generally I believe, to what finish? Yes, it’s irresponsible, nevertheless it doesn’t really feel like I’ll ever be capable to save enough funds to cowl the huge stuff – finding out the damp-proofing, getting married, retiring (ha, the very concept!) – so why not spend the disposable revenue I do have on treats that may carry me pleasure?

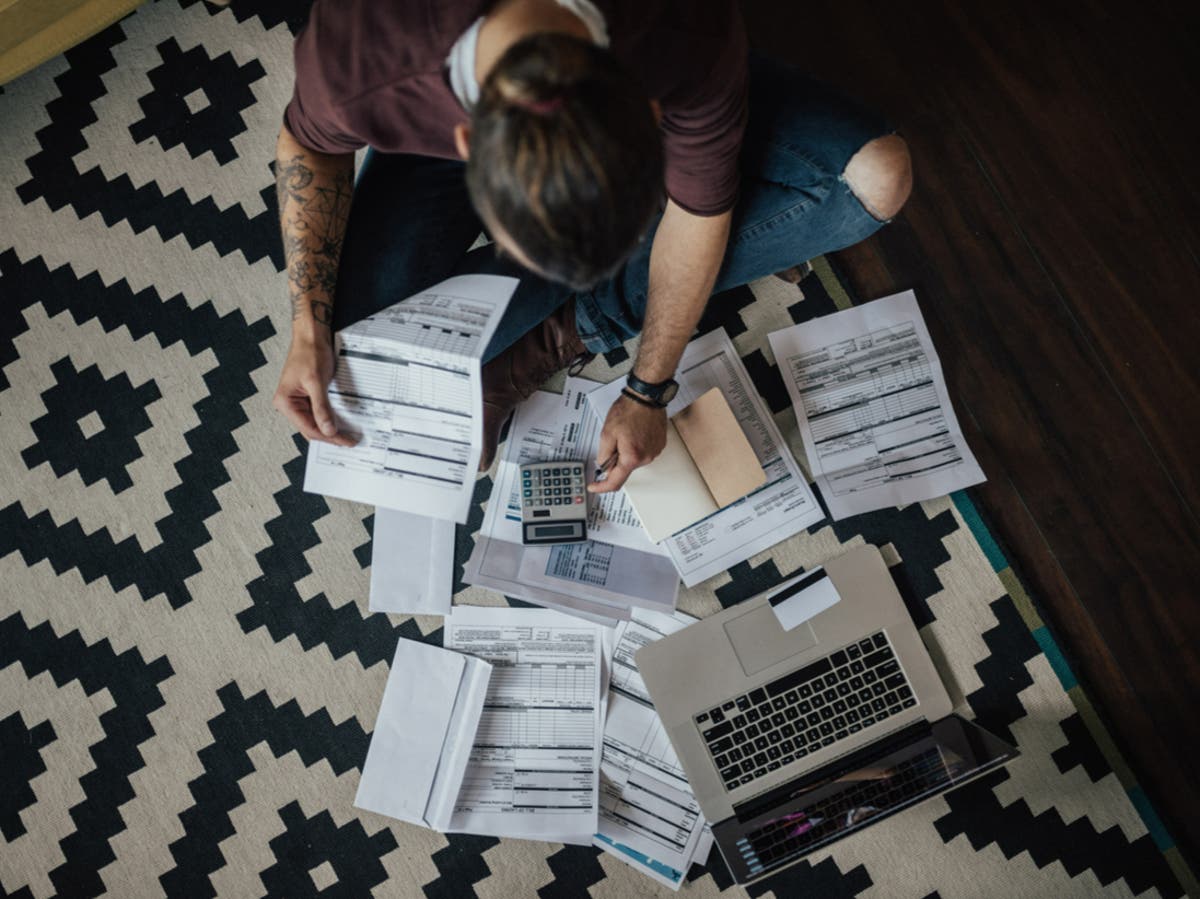

Credit crunch: People with no financial savings are paying for greater outgoings on playing cards

(Getty Images/iStockphoto)

This sentiment is shared by Grace*, a 40-year-old mum of 1 in a well-paid, full-time enhancing job. She presently earns £50k; her associate can also be employed full-time. Still, they battle to place something apart every month.

She and her associate have a grand complete of £102 of financial savings though, she’s fast so as to add, the quantity of debt they’ve accrued because of an surprising tax invoice signifies that they’re actually in the pink. “I’ve always lived a very hand-to-mouth existence,” she tells me. Having had an early profession typified by badly paid jobs, Grace assumed she would lastly begin saving when she earned more cash. “But I just have a nicer life when that happens,” she says. “If you’ve had to have a reasonably tight belt for a while, the temptation is to enjoy being able to relax for a little bit. Lifestyle creep is real. Earning more, you think: we can go to the cinema instead of watching Netflix; we can afford to pay for a babysitter and have a meal out.”

“Lifestyle creep” is the concept that, as our revenue will increase, so does our way of life. Things that had been beforehand thought of luxuries develop into the norm. It’s why you see tales about undeniably rich folks claiming to be struggling – their outgoings have grown in line with their funds. A brand new kitchen, second residence, non-public college charges and several other holidays a 12 months at the moment are not thought of “nice-to-haves” however “necessities”. MP George Freeman is maybe the excellent instance of the phenomenon; he hit headlines final month for saying he’d give up his function as science minister as a result of he may no longer afford his mortgage funds. This was regardless of being on a wage of virtually £120,000 a 12 months, placing him in the prime 1 per cent of all British earners.

The mortgage concern highlighted by Freeman is actual, although. Grace’s mortgage price was beforehand 1.5 per cent; it’s going to leap to extra like 5 per cent after they remortgage, costing a whole lot of kilos extra a month. Meanwhile, childcare alone prices them £1,500 a month: “Everything’s so expensive.”

If you’ve needed to have a moderately tight belt for a whereas, the temptation is to get pleasure from with the ability to loosen up for a little bit. Lifestyle creep is actual

While Ophie, 35, from Kent, earns considerably less than Grace, she has far fewer main outgoings. She works three jobs – as an artist, bartender and store assistant – that add as much as extra than a full-time job. Renting a flat with her husband, who’s employed full-time, Ophie is free from the prices of being a home-owner; doesn’t personal a automotive; and doesn’t have youngsters. Still, she says, she presently has simply £130 in financial savings.

“At one point, that would have terrified me,” she tells me. “The thought of not having an escape route… Now, I’m just numb to it.”

Having by no means been out of labor since leaving training, Ophie has nonetheless at all times discovered it a problem to place cash apart. “The cost-of-living crisis hasn’t helped as a follow-up to Covid,” she says. “But also my entrance into the working world was during the financial crisis. It’s always been a struggle.”

Ophie has accepted that, if a huge surprising invoice comes their means, she and her husband will merely “make it work”. Most lately, their beloved canine wanted an operation that pet insurance coverage wouldn’t cowl. The £900 price of the process went straight on credit score, to be paid again in month-to-month instalments. “I’m quite nonchalant about it these days,” she says of borrowing. “I’ve sadly gotten used to it.”

George Freeman stated he give up his ministerial function as a result of he couldn’t afford his mortgage on the wage

(PA Archive)

Assistant headteacher Clare* from East London, who presently earns £46,000 a 12 months, studies a related battle. The mom of three has a private and a joint bank account – each are presently overdrawn. “I had some savings before I met my husband,” she says. “I was always good with money. But we bought our first house and did it up, and then had two kids, before moving to a bigger house which we also renovated. In terms of moving up the pay scale at work, our SLT (senior leadership team) took a pay freeze to help the school’s finances about four years ago.”

She says it’s “scary” to search out herself in this monetary place aged 40, however tries to look on the shiny aspect: “I live in a lovely house and we can afford to pay the bills so we are very lucky.”

So how did we get into a place the place so many people have no financial security internet?

Education is one space in which the UK has been traditionally weak. Two-thirds of young adults who skilled monetary difficulties consider higher monetary training may have helped them, analysis carried out by assume tank the Centre for Social Justice revealed. Although monetary training was formally added to the curriculum for secondary colleges run by native authorities in 2014, it was largely integrated into non-core topics equivalent to PSHE, with the FT’s Financial Literacy and Inclusion Campaign (Flic) discovering that strain on lecturers and lack of time impacted on the supply of provision. Meanwhile, it nonetheless isn’t even obligatory without spending a dime colleges and academies.

And getting in there early does make a distinction. A 2022 survey by the Money and Pensions Service (MaPS) discovered that youngsters who acquired a significant monetary training had been extra probably to economize extra usually, really feel extra assured about managing their cash, and exhibit constructive day-to-day cash administration abilities.

At one level, that will have terrified me, the considered not having an escape route… Now, I’m simply numb to it

There is no less than some indication that issues may be altering on this entrance; in November 2023 it was introduced that the UK’s failures relating to educating monetary training can be investigated by MPs in a formal overview. The UK Strategy for Financial Wellbeing has set a objective of two million extra youngsters and young folks receiving a significant monetary training by 2030.

The reply proposed by the Resolution Foundation, the assume tank behind the unique financial savings analysis, is to construct upon the present auto-enrolment pension scheme. It has urged upping the contributions from 8 to 12 per cent – with employers and workers placing in 6 per cent every – and ringfencing 2 per cent of the complete cash into an easy-access “sidecar savings” scheme of as much as £1,000, which individuals can dip into pre-retirement after they’re in want.

As for Grace, though she’s lately been pondering extra about saving, there stays little incentive to take action. “There’s nothing to encourage us to save, really,” she says. “The government doesn’t want you to save – they want you to spend so that it benefits the economy. So really, by going out to dinner, I’m helping us all!”

*Names have been modified

[ad_2]

Source hyperlink