[ad_1]

Andy Cohen, the host of Bravo’s “Watch What Happens Live with Andy Cohen,” not too long ago revealed he was scammed out of a big sum of cash by an imposter who pretended to be from his bank.

He shared his story on TV, social media and on his Sirius XM “Andy Cohen’s Daddy Diaries Podcast,” hoping to lift consciousness and forestall others from falling into the identical entice.

“Andy Cohen’s Daddy Diaries Podcast” (Sirius XM)

What is an imposter scam?

An imposter scam is when somebody contacts you pretending to be somebody you belief, comparable to a authorities official, a bank worker, a member of the family or a good friend.

They might use pretend names, cellphone numbers, electronic mail addresses, or web sites to trick you into giving them your cash or private info. They can also use threats, guarantees or emotional appeals to stress you into appearing shortly.

According to the Federal Trade Commission (FTC), imposter scams are the commonest sort of fraud reported by shoppers in the U.S.

How did Andy Cohen get scammed?

Cohen stated that his ordeal began when he misplaced his bank card and reported it misplaced. The subsequent day, he acquired an electronic mail that seemed prefer it was from his bank’s fraud alert system. The electronic mail requested him to click on on a hyperlink and signal in to his bank account to confirm some suspicious transactions. This is the way it all went down from there.

Andy Cohen (Getty Images for Sirius XM)

The pretend electronic mail that began all of it

Cohen stated he clicked on the hyperlink and entered his username and password, considering that the e-mail was reliable. However, he later realized that the hyperlink was pretend and that he had given the scammers entry to his bank account.

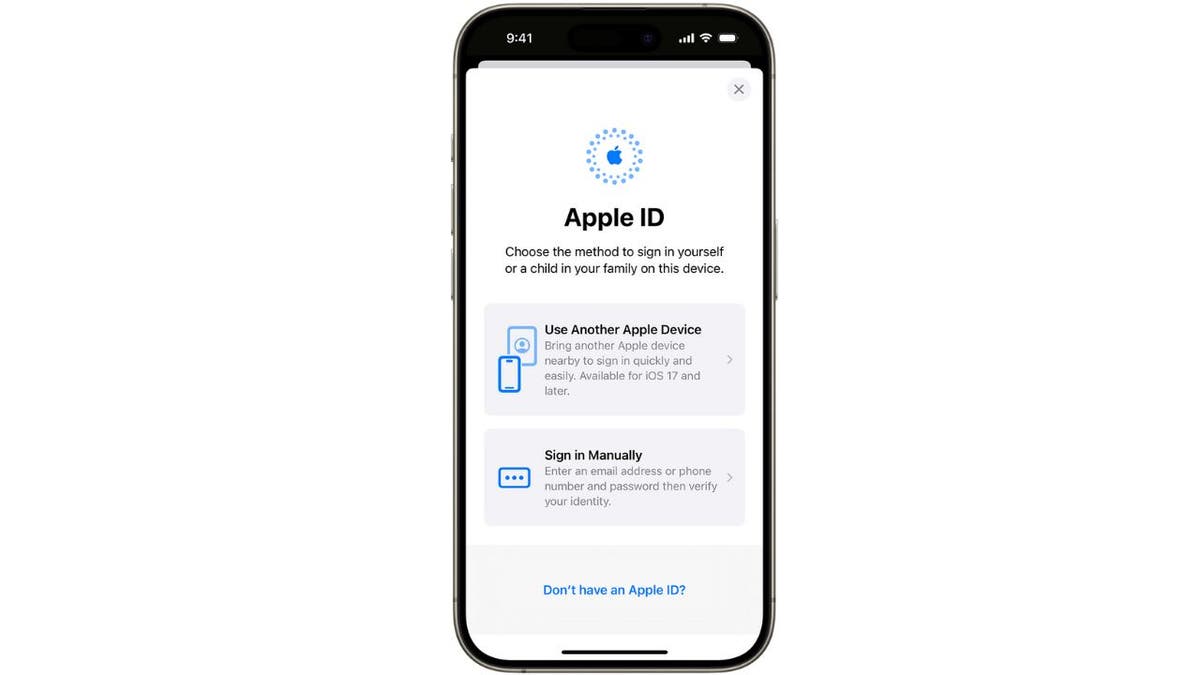

The Apple ID request that gave them entry

The scammers then requested him to signal in to his Apple ID, which he stated was a pink flag. He stated he closed the browser and ignored the request, however it was too late. The scammers had already gained management of his cellphone and his bank account.

Apple ID on iPhone (Apple)

The textual content and cellphone name that confirmed the scam

The subsequent day, he acquired a textual content message from what gave the impression to be his bank, asking him if he was attempting to make use of his card. He replied that it was not him, after which he acquired a cellphone name from somebody who claimed to be from his bank’s fraud division.

The caller requested him to substantiate some latest costs on his account, which he stated have been correct as a result of the scammers may see his transactions. The caller then stated they might ship him some codes to confirm his id and requested him to learn them again.

The codes that have been really wire transfers

Cohen stated he acquired three codes, which he later realized have been really wire transfers from two of his accounts to the scammers. He stated he thought he was speaking to his bank and that the codes have been a part of the safety course of.

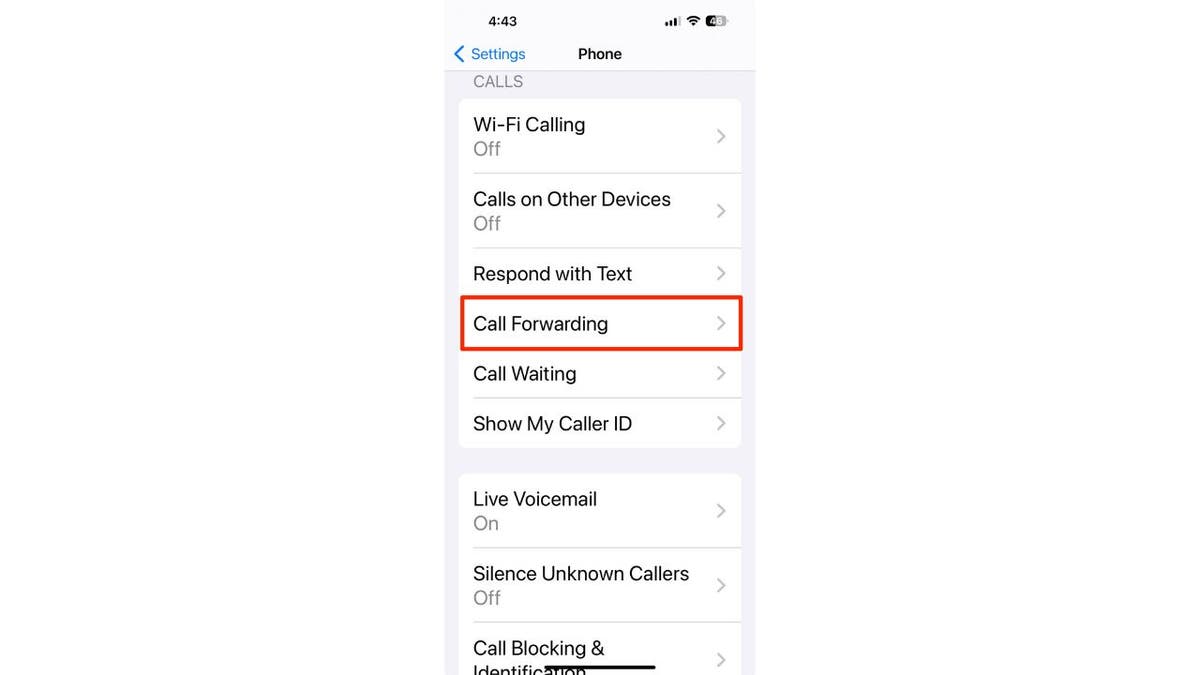

The call-forwarding trick that blocked the true bank

The scammers then did one thing much more sneaky. They requested him to enter some numbers, which they gave him, on his cellphone’s keypad, which activated the call-forwarding characteristic. This meant that any incoming calls to his cellphone can be redirected to the scammers, together with the calls from his actual bank.

Call forwarding on iPhone (Kurt “CyberGuy” Knutsson)

Cohen stated he tried calling his bank’s fraud quantity however by no means acquired a callback. He stated his cellphone was silent all evening, which he discovered unusual. The subsequent day, a go to to his bank revealed {that a} important sum of cash had been wired out of his account, the precise quantity of which he didn’t reveal. Cohen highlighted the cruel actuality that when cash is wired out, it is usually not recoverable.

The discovery of the loss and the report back to the police

He stated he reported the incident to the NYPD Cyber Security Unit and that the case was nonetheless underneath investigation. He stated he needed to share his expertise to warn others.

MORE: PROTECT YOURSELF FROM TECH SUPPORT SCAMS

How are you able to keep away from imposter scams?

Andy Cohen shared some recommendations on the right way to keep away from imposter scams primarily based on what he realized from his expertise. Here is his recommendation, together with some extra ideas.

1) Check the e-mail deal with

If you obtain an electronic mail that claims to be out of your bank, your authorities, or another group, at all times examine the sender’s electronic mail deal with. It might look official, however in case you click on on it, you might even see that it isn’t from the area you count on. For instance, it could say “Bank of America,” however the electronic mail deal with could also be one thing like “bankofamerica@gmail.com” or “bankofamerica@fraud.com.” Do not click on on any hyperlinks or attachments in the e-mail, and don’t reply to it. Instead, contact the group instantly utilizing a cellphone quantity or an internet site that you already know is real.

2) Avoid the sense of urgency

Many imposter scams depend on creating a way of urgency or panic in the sufferer. They might inform you that your account has been hacked, that you just owe cash to the IRS, that the one you love is in hassle, or that you’ve got gained a prize. They might ask you to behave shortly and ship cash, present private info, or purchase reward playing cards. Do not allow them to rush you or stress you. Take a breath and assume twice earlier than you reply. If you aren’t certain, discuss to somebody you belief, comparable to a good friend, a member of the family, or a monetary advisor. Remember, reliable organizations won’t ever ask you to pay them with reward playing cards, wire transfers, or cryptocurrency.

3) Verify the caller’s id

If you obtain a cellphone name from somebody who claims to be out of your bank, your authorities, or another group, don’t belief them blindly. They might use pretend names, cellphone numbers, or caller ID info to idiot you. They can also have some details about you, comparable to your title, your deal with, or your account quantity, to make you assume they’re actual. However, this doesn’t imply they’re who they are saying they’re. They might have obtained this info from public sources, knowledge breaches, or earlier scams. Do not give them any extra info, comparable to your password, your PIN, your social safety quantity, or your bank card quantity. Do not comply with any requests, comparable to sending cash, shopping for reward playing cards, or getting into codes. Instead, cling up and name the group instantly utilizing a cellphone quantity that you already know is real. You also can examine the group’s web site for any alerts or warnings about scams.

4) Protect your units: Have good antivirus software program on all of your units

Imposter scammers might attempt to entry your units, comparable to your laptop, your cellphone, or your pill, to steal your info or cash. They might ship you pretend emails, texts, or pop-ups that ask you to click on on a hyperlink, obtain a file, or set up software program. Do not do it.

CLICK HERE TO SIGN UP FOR THE ENTERTAINMENT NEWSLETTER

They can also ask you to signal in to your on-line accounts, comparable to your electronic mail, your bank, or your Apple ID. Do not fall for these methods. They might infect your units with malware, spyware and adware, or ransomware, or they could lock you out of your accounts.

The finest option to shield your self from these kinds of cyberthreats or having your knowledge breached is to have antivirus safety put in on all of your units. Having good antivirus software program actively operating in your units will warn you of any malware in your system, warn you in opposition to clicking on any malicious hyperlinks in phishing emails, and in the end shield you from being hacked. Get my picks for the very best 2024 antivirus safety winners to your Windows, Mac, Android & iOS units.

5) Use robust and distinctive passwords

Create robust passwords to your accounts and units, and keep away from utilizing the identical password for a number of on-line accounts. Consider utilizing a password supervisor to securely retailer and generate complicated passwords. It will aid you to create distinctive and difficult-to-crack passwords {that a} hacker may by no means guess. Second, it additionally retains observe of all of your passwords in one place and fills passwords in for you while you’re logging into an account so that you just by no means have to recollect them your self. The fewer passwords you bear in mind, the much less doubtless you’ll be to reuse them to your accounts.

6) Perform common software program updates

Developers steadily launch updates to patch vulnerabilities and enhance general safety. Both Apple and Android problem updates often, so examine for and set up them typically.

Scam alert illustration (Kurt “CyberGuy” Knutsson)

MORE: THE ‘UNSUBSCRIBE’ EMAIL SCAM IS TARGETING AMERICANS

I’ve been scammed like Andy. What to do subsequent?

Below are some subsequent steps in case you discover you or the one you love is a sufferer of id theft from an imposter scam.

1) Change your passwords. If you believe you studied that your cellphone has been hacked or that somebody is impersonating you, they may entry your on-line accounts and steal your knowledge or cash. ON ANOTHER DEVICE (i.e., your laptop computer or desktop), it’s best to change your passwords for all of your vital accounts, comparable to electronic mail, banking, social media, and so on. You need to do that on one other gadget so the hacker isn’t’ recording you organising your new password in your hacked gadget. Use robust and distinctive passwords which can be laborious to guess or crack. You also can think about using a password supervisor to generate and retailer your passwords securely.

2) Look by bank statements and examine account transactions to see the place outlier exercise began.

CLICK HERE TO GET THE FOX NEWS APP

3) Use a fraud safety service. Identity Theft corporations can monitor private info like your Social Security Number (SSN), cellphone quantity, and electronic mail deal with and warn you whether it is being offered on the darkish net or getting used to open an account. They also can help you in freezing your bank and bank card accounts to forestall additional unauthorized use by criminals.

Some of the very best elements of utilizing an id theft safety service embrace id theft insurance coverage to cowl losses and authorized charges and a white glove fraud decision crew the place a US-based case supervisor helps you get well any losses. See my suggestions and finest picks on the right way to shield your self from id theft.

4) Report any breaches to official authorities businesses just like the Federal Communications Commission.

5) You might want to get the skilled recommendation of a lawyer earlier than chatting with legislation enforcement, particularly if you find yourself coping with prison id theft and if being a sufferer of prison id theft leaves you unable to safe employment or housing

6) Alert all three main credit score bureaus and probably place a fraud alert in your credit score report.

7) Run your personal background examine or request a duplicate of 1 if that’s the way you found your info has been utilized by a prison.

8) Alert your contacts. If hackers have accessed your gadget by SMS spoofing, they may use them to ship spam or phishing messages to your contacts. They may impersonate you and ask for cash or private info. You ought to alert your contacts and warn them to not open or reply to any messages from you that appear suspicious or uncommon.

9) Restore your gadget to manufacturing facility settings. If you need to make it possible for your gadget is totally freed from any malware or spyware and adware, you possibly can restore it to manufacturing facility settings. This will erase all of your knowledge and settings and reinstall the unique model. You ought to again up your vital knowledge BEFORE doing this, and solely restore it from a trusted supply.

If you’re a sufferer of id theft, crucial factor to do is to take speedy motion to mitigate the harm and forestall additional hurt.

MORE: ALL NEW TRICKY THREAT OF THE FAKE BROWSER UPDATE SCAM

Kurt’s key takeaways

Imposter scams are a critical menace that may value you some huge cash and stress. Andy Cohen realized this the laborious method, however he determined to share his story to assist others keep away from the identical mistake.

By following his suggestions and the FTC’s recommendation, you possibly can shield your self and your family members from imposter scammers. Remember, if one thing sounds too good to be true, or too unhealthy to be true, it in all probability is. Be good, be vigilant, and be protected.

How do you assume the authorities and the banks ought to deal with imposter scams and assist the victims get well their losses? Let us know by writing us at Cyberguy.com/Contact.

For extra of my tech suggestions & safety alerts, subscribe to my free CyberMan Report Newsletter by heading to Cyberguy.com/Newsletter.

Ask Kurt a query or tell us what tales you want us to cowl.

Answers to essentially the most requested CyberMan questions:

Copyright 2024 CyberMan.com. All rights reserved.

[ad_2]

Source hyperlink