[ad_1]

National Insurance funds had been reduce for thousands and thousands of staff within the first week of January.

However, different adjustments imply the quantity of tax folks pay general is rising to report ranges.

How is National Insurance altering for workers?

From 6 January, 27 million staff pay 10% on earnings between £12,571 and £50,270 through the tax yr, which runs from 6 April to five April the next yr. This replaces the earlier National Insurance (NI) fee of 12%.

For somebody on a median full-time wage of £35,000 the reduce is value about £450 a yr, in accordance with the Institute for Fiscal Studies assume tank.

Type your annual wage within the calculator beneath to work out how this variation impacts you.

Your machine could not assist this calculator

NI on earnings and income above £50,270 will stay at 2%.

NI is not paid by folks over state pension age, even when they’re working.

Eligibility for some advantages, together with the state pension, is determined by the quantity of NI funds you’ve gotten made.

NI charges apply throughout the UK.

How is National Insurance altering for the self-employed?

From 6 April 2024, two million self-employed folks will pay 8% on income between £12,571 and £50,270, down from 9%.

From the identical date, the self-employed will now not pay a separate class of NI known as Class 2 contributions.

The authorities says the 2 measures will be value £350 a yr for a self-employed particular person incomes £28,200.

What is taking place to National Insurance thresholds?

The stage of earnings at which you begin paying NI (the edge) has been frozen at £12,570 till 2028.

It signifies that as wages rise, extra folks will need to pay NI.

Why are thousands and thousands paying extra earnings tax?

As wages rise, extra folks will even have to start out paying earnings tax, and a higher quantity will need to pay increased charges.

This is as a result of, as with NI, thresholds are being frozen till 2028.

The tax-free private allowance is staying at £12,570. (Most taxpayers don’t pay any tax on earnings beneath this stage).

The level at which increased tax charges take impact is additionally frozen at £50,271.

The freezes will create 3.2 million additional taxpayers by 2028, and 2.6 million extra folks will pay increased charges of tax. That’s in accordance with the Office for Budget Responsibility (OBR), which independently assesses the federal government’s financial plans.

It expects the coverage to boost £25.5bn extra a yr by 2027-28 than if the NI and earnings tax thresholds had gone up in keeping with inflation.

According to the IFS financial assume tank, by 2027-28 an worker incomes £35,000 “will be paying about £440 a year more in direct tax overall as a result of all the changes to income tax and NICs since 2021”.

What are the present charges of earnings tax?

You pay earnings tax to the federal government on earnings from employment and income from self-employment.

Income tax is additionally paid on some advantages and pensions, earnings from renting out property, and returns from financial savings and investments above sure limits.

These charges apply in England, Wales and Northern Ireland:

The primary fee of earnings tax is 20% and is paid on earnings between £12,571 and £50,270 through the tax yr.

The increased fee of earnings tax is 40%, and is paid on earnings between £50,271 and £125,140.

Once you earn greater than £100,000 a yr, you additionally begin shedding your tax-free private allowance. This means it’s important to pay earnings tax of 40% on a number of the first £12,570 of your earnings.

You lose £1 of your private allowance for each £2 that your earnings goes above £100,000. So should you earn greater than £125,140 a yr, you now not get any tax-free private allowance.

The further fee of earnings tax is 45%, and is paid on all earnings above £125,140 a yr.

How is tax totally different in Scotland?

Some earnings tax charges are totally different in Scotland.

From April 2023 the charges are:

- Tax-free private allowance: £12,570 (decreased by £1 for each £2 earned above £100,000)

- Starter fee of 19%: £12,571 to £14,732

- Scottish primary fee of 20%: £14,733 to £25,688

- Intermediate fee of 21%: £25,689 to £43,662

- Higher fee of 42%: £43,663 to £125,140

- Top fee of 47%: above £125,140

In December, the Scottish authorities introduced a brand new “advanced” fee of 45% for these incomes between £75,000 and £125,140. The prime fee of tax will additionally enhance to 48%.

From April 2024, the brand new charges will be:

- Tax-free private allowance: £12,570 (decreased by £1 for each £2 earned above £100,000)

- Starter fee of 19%: £12,571 to £14,876

- Scottish primary fee of 20%: £14,877 to £26,561

- Intermediate fee of 21%: £26,562 to £43,662

- Higher fee of 42%: £43,663 to £75,000

- Advanced fee of 45%: £75,001 to £125,140

- Top fee of 48%: above £125,140

The Scottish authorities estimates that 114,000 folks will pay the brand new superior tax fee and an extra 40,000 the highest fee.

Who pays most in earnings tax?

For most households, earnings tax is the one largest tax.

But for poorer households, a higher share of household earnings goes on taxes on spending (oblique taxes).

For the poorest fifth of households, VAT is the largest single tax paid.

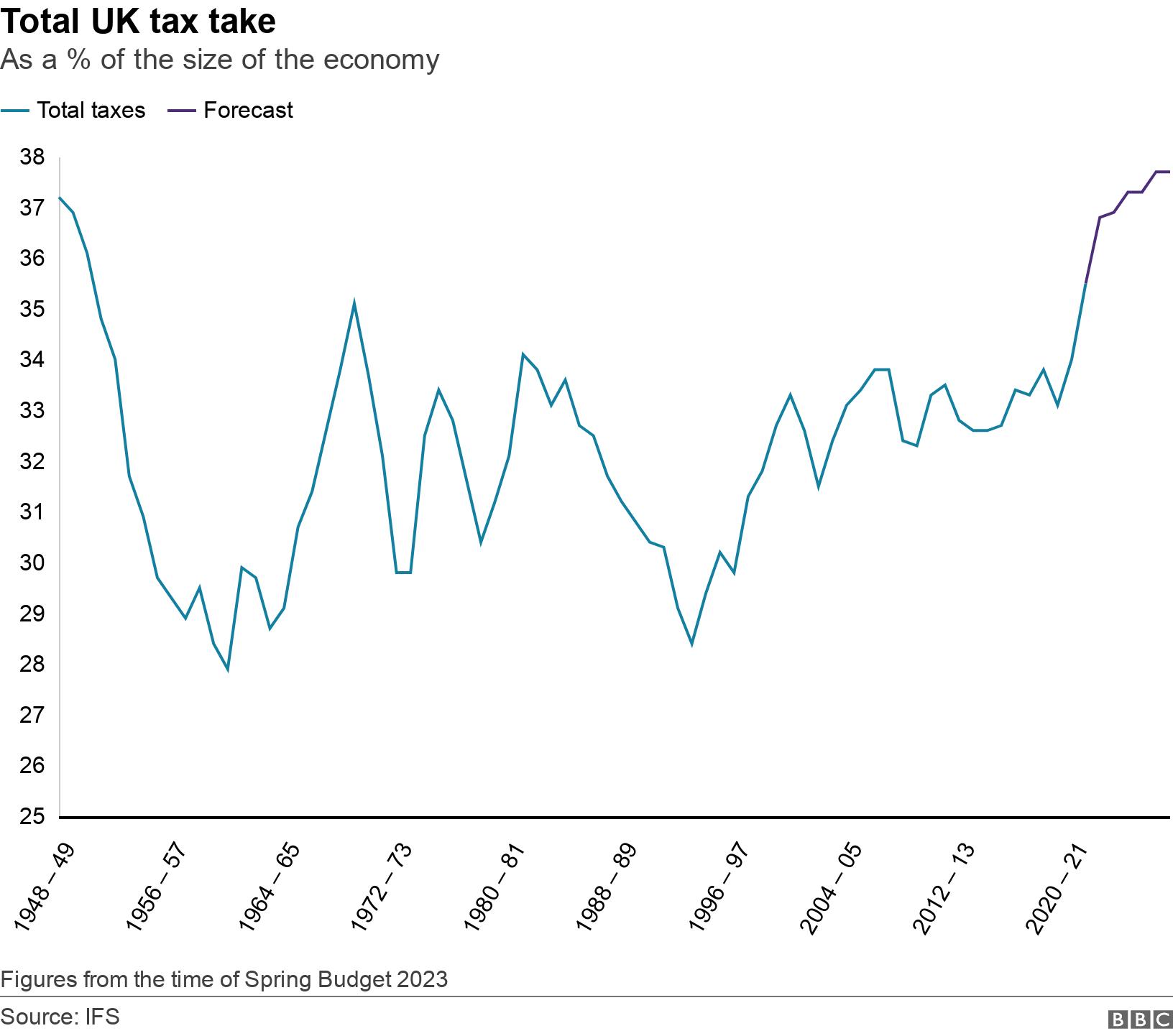

How excessive are UK taxes traditionally?

One manner of measuring how excessive general taxes are is to match them with the dimensions of the economic system.

At the time of the 2023 Autumn Statement, the OBR stated they might rise “in each of the next five years to a post-war high of 38% of GDP”.

How do UK taxes examine with different international locations?

If you have a look at the quantity of tax raised as a proportion of the dimensions of the economic system in 2022 – the latest yr for which worldwide comparisons will be made – the determine was 35.3%.

That places the UK proper in the course of the G7 group of massive economies.

France, Italy and Germany tax extra, Canada, Japan and the US tax much less.

[ad_2]

Source hyperlink