[ad_1]

For weary dad and mom rolling up their sleeves for around-the-clock diaper responsibility, a bill with bipartisan support in Kentucky would ship tax aid when buying a necessity that provides as much as a hefty expense.

The measure would exempt diapers from the state’s 6% gross sales tax. Senators from each events have signed on as cosponsors, and the proposal acquired a hearty endorsement from the operator of a Kentucky diaper financial institution who says it goes to the center of a harsh actuality for some struggling households — slicing again on meals and different bills to maintain their infants in contemporary diapers or reusing disposable diapers.

“When people hear about this bill, it’s something they all understand,” Democratic Sen. Cassie Chambers Armstrong, the bill’s lead sponsor, mentioned in an interview Friday. “Anyone who has young children or young grandchildren understands that diapers are really expensive. They understand that several hundred dollars a month for a family with two kids in diapers is a huge expense and families need relief.”

KENTUCKY REPUBLICAN REINTRODUCES BILL TO END ODD-YEAR ELECTIONS

With two younger youngsters of her personal, Chambers Armstrong can relate to the frequent runs to the shop to purchase diapers. By waiving Kentucky’s gross sales tax for diaper purchases, households with infants or toddlers might save hundred of {dollars} every year, she mentioned. The proposed exemption additionally would apply to grownup diapers.

“It adds up over time,” Chambers Armstrong mentioned of the financial savings. “It sounds small — 6% — but every penny counts when you’re counting pennies.”

The battle to afford diapers is a rising downside, in accordance with the National Diaper Bank Network. When households cannot afford a relentless provide of fresh diapers, their infants are extra susceptible to painful rashes and urinary tract infections and require extra physician visits, the group mentioned. Parents threat lacking work or faculty if they will’t afford the diapers required to go away their child in youngster care, it mentioned.

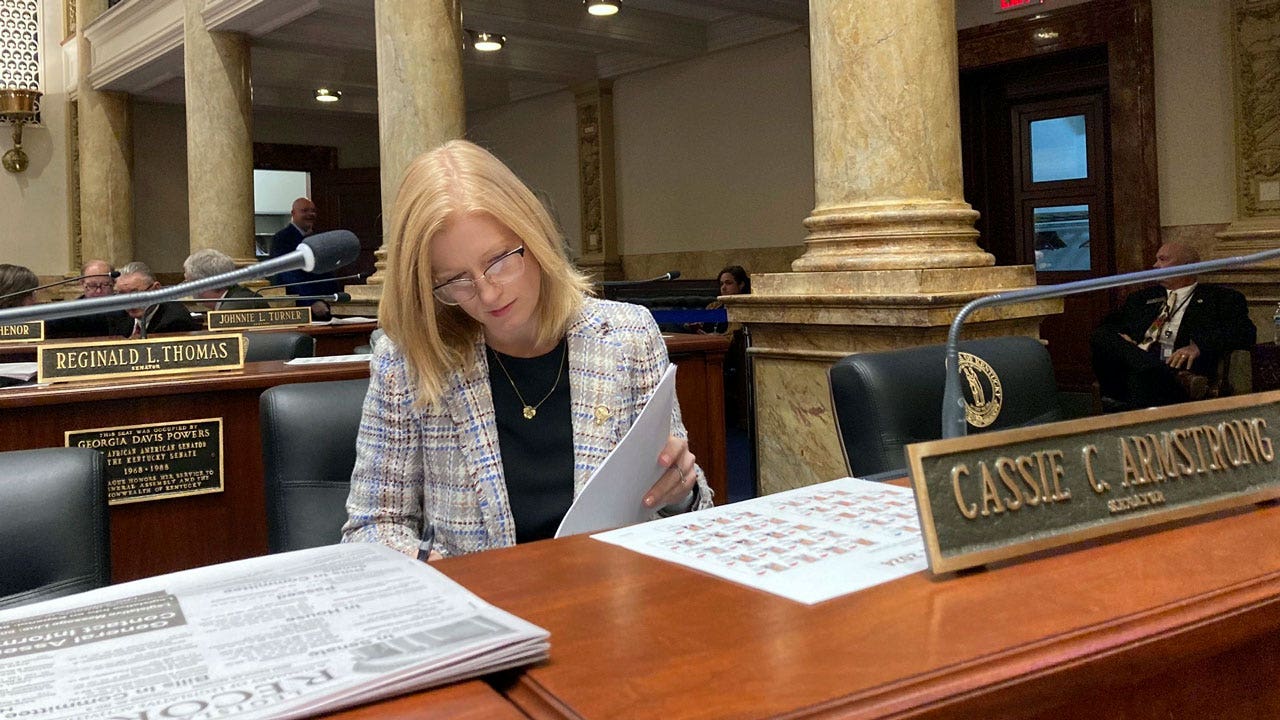

Seen right here at her desk within the Kentucky state Senate chamber, Kentucky state Sen. Cassie Chambers Armstrong leads the cost on a bipartisan bill that might exempt diapers from the state gross sales tax. (AP Photo/Bruce Schreiner)

As of final summer season, 26 states had been charging gross sales tax on diapers, the group mentioned. The diaper tax could be as little as 4% or as excessive as 7%, it mentioned. Children require no less than 50 diaper modifications per week, it mentioned.

Deanna Hornback, who runs a Louisville-area diaper financial institution, mentioned she has heard of households rinsing out or taping disposable diapers to maintain them in use. She referred to as it a “silent need” that’s turning into extra prevalent, and he or she mentioned that passing the tax exemption would ship badly wanted aid for households.

“You’ll not only be reaching those … impoverished families, you will actually reach those who fall between the cracks, who struggle or who have too much pride to ask for the help,” she mentioned in a telephone interview Thursday. “So this bill is going to help everybody.”

In a legislative chamber dominated by Republicans, Chambers Armstrong has damaged by means of as a Democrat with an concept that’s resonating along with her Republican colleagues. Senate Majority Floor Leader Damon Thayer is among the many Republicans including their names to the bill as cosponsors.

“I think it’s a really good bill,” Thayer mentioned Friday. “We’re Republicans. We’re for cutting taxes. Diapers are a required staple of life.”

While the bill has drawn appreciable consideration, the precise pathway for enacting a gross sales tax exemption for diaper purchases is not but clear. Revenue payments have to start out within the House, so the language in Chambers Armstrong’s proposal might find yourself being hooked up to a House measure, Thayer mentioned.

“However it gets done is a win,” Chambers Armstrong mentioned.

CLICK HERE TO GET THE FOX NEWS APP

Applying the exemption to diaper purchases would value the Bluegrass State an estimated $10 million a 12 months in income — a minuscule quantity in contrast with the price of present gross sales tax exemptions for meals and drugs and at a time when Kentucky has large finances reserves from surging tax collections.

Chambers Armstrong sees the projected fiscal affect for her bill as too excessive, saying Kentuckians will probably spend financial savings from the diaper exemption on different household requirements.

Whatever the fee to state coffers, the diaper tax exemption would assist ease the pinch on household budgets, she mentioned.

“Whenever you have young children, diapers — purchasing them, affording them — is one of the things that you think about every single day,” she mentioned. “And I’m lucky that we had the resources to be able to afford the diapers we needed. But there were so many expenses when we first had our two children, you just think about all the families that struggle and what you can do to help them.”

[ad_2]

Source hyperlink